Our Journal.

Why Income Protection Insurance Matters

What is Your Biggest Asset?

Is your biggest asset your house, your business, or maybe your new car? Or could it be something less obvious but just as crucial—your ability to earn an income? After all, it’s your income that pays for these things and builds a secure future. But life is unpredictable, and a sudden illness or accident could disrupt your ability to work, impacting your finances and long-term plans. Income Protection insurance offers a financial safety net, safeguarding that earning power so you can focus on recovery instead of worrying about lost income. Let’s explore how this cover works and why it’s worth considering.

What Is Income Protection Insurance?

Income Protection insurance provides regular payments, typically covering up to 75% of your income, if you’re unable to work due to illness or injury. Unlike other insurance policies, it’s tailored to replace your income during a difficult period, giving you a steady stream of funds to cover everyday expenses, such as rent or mortgage payments, bills, and groceries.

The Power of Regularly Reviewing your Insurance cover

Life is full of changes, which is why it is crucial to ensure your coverage still meets your needs and budget. Even small changes like moving house, increasing your mortgage, changing jobs or relationship status can impact your level of risk. A quick regular check in with a qualified advisor can highlight gaps in your cover or provide ways to save on premiums. Over the past two years alone, regular reviews with our advisors have helped us identify and process 6 Trauma claims, totalling over $877,000 being paid to our clients. Imagine not realising you had a potential claim, cancelling your cover and missing out altogether.

Understanding Health Insurance in New Zealand

How Does Health Insurance Work in New Zealand?

In New Zealand, health insurance complements the public healthcare system. While all Kiwis have the right to access public healthcare, the system often faces long waiting times and resource constraints. Health insurance allows policyholders to bypass these delays, providing access to high-quality private medical facilities and specialists.

Types of Health Insurance

• Surgical and Hospital Cover: Covers the costs of surgeries and hospital stays. This is crucial for major medical events, ensuring timely and necessary treatments.

• Specialist and Diagnostic Cover: Pays for specialist consultations and diagnostic tests like MRIs and X-rays, essential for accurate diagnosis and treatment planning.

• Day-to-Day Cover: Includes expenses for general practitioner (GP) visits, prescriptions, dental care, and optical services. It helps manage routine healthcare costs.

Are Insurance Advisors and Insurance Brokers the same thing?

Insurance brokers primarily operate in the general insurance market. Acting as intermediaries between clients and insurance companies, brokers negotiate terms and premiums for various types of insurance such as house, contents, car, commercial and liability covers. They work closely with specific insurance companies, navigating the underwriting process based on clients’ needs, claims history, and risk profiles to secure suitable offers. Brokers will collect your premiums directly sometimes charging an administrative fee before passing them onto the Insurer.

On the other hand, insurance advisors , like Abacus Group Advisors are independent professionals who collaborate with all the major Life Insurers in the New Zealand Market. Clients pay their premiums directly to the Life Insurer; these are not handled by the advisors. Abacus Group advisors are paid a commission from the Life Insurer and do not charge you a fee for their advice.

New Year - New Insurance

Abacus Group advisors are your local team to help you and your family find the best insurance package on the market. We can help with Life, Health, Trauma, Mortgage & Income Protection and Business Insurance – a one stop shop for your insurance needs.

Learn more about our team here and let’s get talking about how you can get the best out of your insurance in 2024.

Pharmac, Medical Insurance & access to treatment in NZ.

What is Pharmac?

Pharmac is a government agency in New Zealand that controls access to and funding of new medication. They make decisions about which drugs/treatments to support based on criteria such as clinical evidence, cost-effectiveness, and potential health benefits.

Why is this an issue for Kiwis?

Pharmac's funding decisions directly impact access to healthcare and prescription medications for millions of New Zealanders.

They subsidise 2000+ drugs and medical products, but budget constraints and high drug costs prevent funding of additional Medsafe-approved medicines for Kiwis. Meaning many drugs/treatments may not be covered.

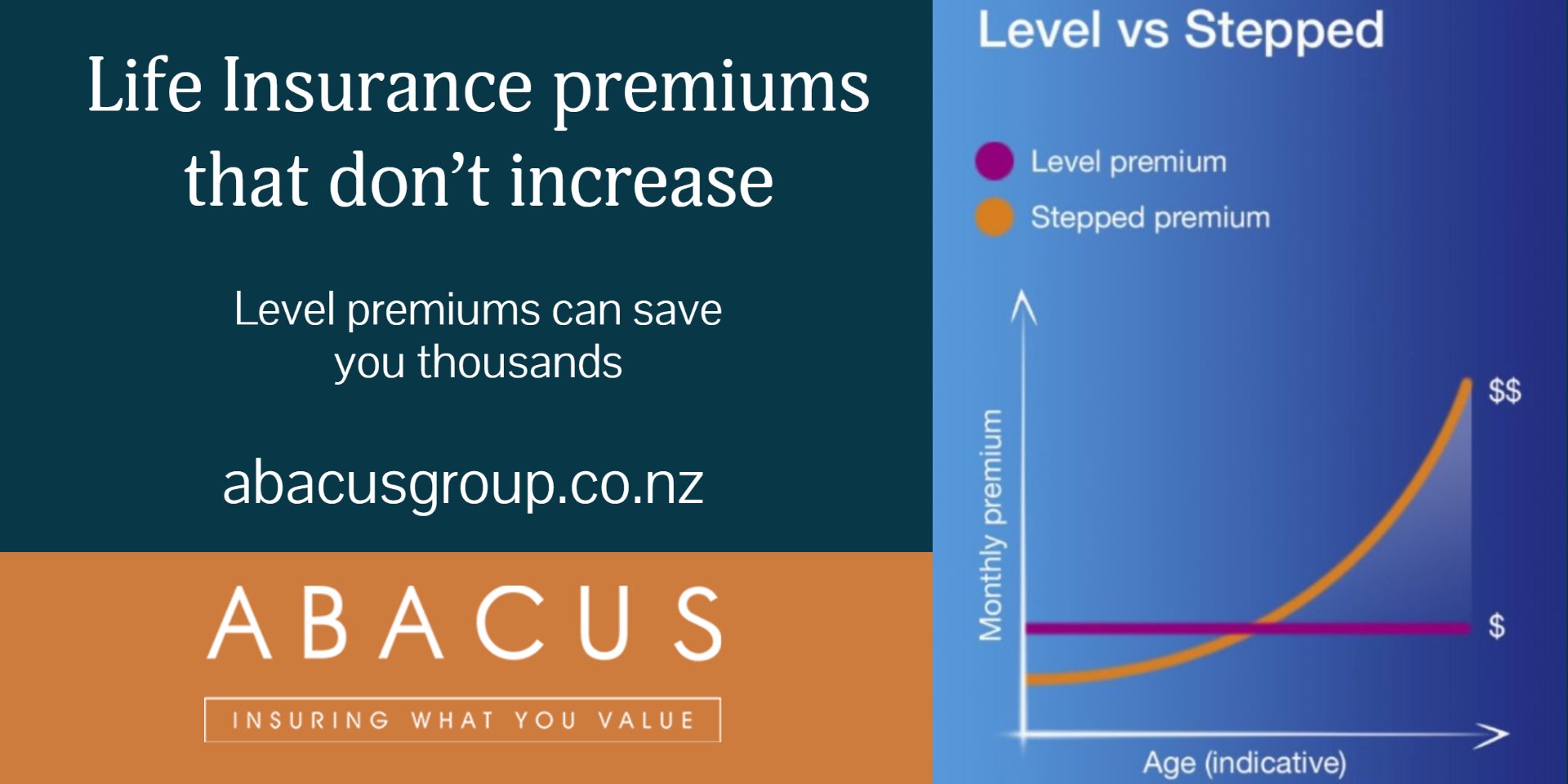

Finding the right fit: Level vs Stepped premiums

Both premium structures can be suitable for different age groups depending on their individual circumstances, financial situation and goals. Abacus advisor Scott Crocker explains the difference. Get in touch with the team today.

ACC Structure for Business Owners

If you are a self-employed business owner who has ditched the PAYE salary and you are running your own business, no doubt you have a constantly growing ‘to do’ list. Something that is often neglected is the improved structuring of your ACC levies.

With the right advice it is easy to improve and streamline your ACC experience and ensure you have the correct set up for you and your business. To do this there are two ACC structures that self-employed Kiwis need to consider:

1. ACC Cover Plus Standard (ACC Standard)

2. ACC Cover Plus Extra

25 Years in Business Competition

Thanks to all our clients who took the time to provide us with feedback and entered our 25 Years in business Prezzy Card competition.

Financial Advice New Zealand - Rising Star Award 2022

We are very proud to announce Scott Crocker was awarded the 2022 Financial Advice New Zealand Rising Star Award. Congratulations Scott.

Adding Up 25 Years of Service

September 1st 2022 marks 25 years in business for Abacus Group. Founding directors Craig Nolly and Richard Toon are committed to providing Life Insurance solutions that create true value for clients.

Life Insurance - It’s not for you

It is a weird thing when you think about it.

You need to spend your hard-earned money now, to give someone else some money if you die.

What do you get when you buy Life Insurance - apart from a bunch of money when the event occurs?

The two major triggers for buying Life Insurance are family and debt. These triggers happen because we want certainty for our family even if we aren’t there.

We want to ensure our family can repay the mortgage so that they get to live in their own family home. This means the kids get to wake up in their own bedrooms every morning even though Mum or Dad may have passed early. This means that a surviving life partner does not have to double down on work just at the time the family needs them the most. It means that kids can look back and say, “we are so grateful Mum or Dad had the foresight to look after our financial future.”

Now that’s “Peace of Mind”.

Life Insurance is not for you – it’s for those you leave behind.

Specific Injury Cover

What is it?

Specific Injury Cover provides you, your business, or your farm with an immediate lump sum payment if you suffer one of the specified injuries. The payment is calculated as a multiple of $5,000 (or the sum insured) depending on the severity of the injury (see table below) and it’s your choice how you use the money.

What problem does it solve?

If you suffer an injury because of an accident there are many situations where you will require immediate funds to protect yourself and your business. Any ACC benefit is paid after 7 days and the waiting period on Income Protection will likely be at least 4 weeks. A Specific Injury cover payment offers a supporting benefit to provide a cash injection which may act to replace lost income, hire replacement labour, hire a contract milker, or use as you see fit.

Does this cover replace Income Protection?

Not quite. Specific Injury Cover acts as an affordable additional benefit to provide immediate financial assistance in the event of an injury. However, it does have the potential to fill the gap left during the waiting period between an ACC or Income Protection benefit payment.

Underwriting?

There is no medical or financial underwriting and no high risk or hazardous pursuits exclusions (eg stockcar racing or base jumping etc). This makes the cover extremely valuable for people with pre-exisiting conditons or high risk occupations who are unable to get Income Protection or Trauma Insurance.

Total & Permanent Disablement (TPD) Insurance

What is Total Permanent Disablement (TPD) insurance?

It’s about looking after you and your family’s future if you become totally permanently disabled and are unable to work as a result of an accident or illness. Why do I need it? Permanent disability might not only prevent you from working and earning, but it could also substantially increase the cost of maintaining a comfortable lifestyle for you and your family. With TPD Insurance you will get a lump-sum payment which can assist with your mortgage, cover medical expenses, home alterations or modifications to your car, or other bills so you can focus on adaption of you new world. You can use the lump sum payment to pay for your spouse or family member to take time of work to care for you. Many people require extra help and support when they are dealing with a serious illness or injury.

NZ Income Insurance Scheme

As a professional adviser with 34 years’ experience in exactly this field, I see no problem with such a scheme. Let’s face it, most of us have a family member, a friend or colleague who could benefit from it if the need arises.

How does this effect those of us who already have income cover or mortgage cover, will we still need it, or should we be looking at how this affects us?

My advice is a government short-term fix for a long-term problem is never the total solution. Dovetailing your lawful entitlements with personal responsibility is the answer.

New Zealand’s Public Health System.

It’s great to live in a country with a good Public Health System. So why would you bother spending money on Private Health Insurance in New Zealand? Abacus Group Principle and Advisor Richard Toon explains in our blog. Read online.

Life as an insurance advisor.

Life as an Insurance Adviser.

I often get asked what exactly I do as a Financial Adviser in the Life insurance industry.

What exactly is my role? As an adviser its simple really. I help our clients solve problems. More specifically their financial risk problems.

Life Insurance is a love letter to your family.

Life Insurance is not just a lump sum of money if you die or are diagnosed terminally ill, it is a promise of stability and certainty for your entire family.